As part of our commitment at Rise Legal – Steve Dixon Law to be the top Affordable Las Vegas Lawyer, this blog post seems like a good fit. It is not uncommon for me to sit down with a client or potential client who has some financial issues. In the United States, more than one half of Americans do not have at least $1,000 in a savings account. Thirty-nine percent (39%) of Americans have no savings at all.

At times, clients are referred to me from another attorney who they have seen to discuss bankruptcy as a possible avenue to those financial concerns. Most of the time, bankruptcy can be avoided by beginning to budget properly, pay down debt, and save. It will definitely take some humility and self control, but I’ve seen many people accomplish financial freedom following financial ruin on more than one occasion. Over the years as I’ve met with a variety of people in a variety of situations, I’ve been able to compile a list of budgeting apps, books, and other sources that have helped me advise these clients and myself. Here are the ones I refer to most often.

- First and Foremost – Get out of Debt!

The first book I ever read about getting out of debt was by the infamous Dave Ramsey. He employs the “snowball” method for paying off debts. You can visit his page here: Dave Ramsey Snowball. The snowball method means paying down debts one at a time, then using the prior payment amount to increase the second debt payment. As an example, let’s assume you have three debts. A credit card payment of $100 per month, a student loan payment of $300 per month, and a car payment of $400 per month. Under the snowball method, you would pay as much as you can to take care of the first debt, the credit card, each month. Once the credit card is paid off, you don’t use that extra $100 to buy other things, you add that to the next debt payment. Thus, your student loan payment would now be $400 per month, instead of $300. This would obviously pay off the student loan in a much faster way. When the student loan is paid off, you would now be paying $800 per month (the $100 credit card payment plus the $300 student loan payment plus the $400 car payment) toward the car. Obviously, you would pay off the car much faster than if you were to simply make the minimal monthly payments. Of course, you can choose which debt to pay off first, second, etc. Mr. Ramsey explains those variations in his book. Here’s a free tip from the Affordable Las Vegas Lawyer: you can buy the book used in great condition from somewhere like eBay for probably $5.00.

There are a lot of good debt reduction apps out there, but I personally use Debt Free. It is 0.99 cents on the iTunes App store. I’m sure there are similar apps through other phone providers.

Part of the reason I like this app so much is it allows me to re-order how I want to snowball my debts. It also shows how much money I owe on each debt remaining, how much I’ve paid off, and when the debt will be completely paid off. That is a good thing because it helps me stay focused and encouraged on my debt reduction goal.

- Save Money

It’s hard to save money while you are paying down debt, but you should at least save a little on the side for a rainy day. Like I mentioned above, less than one-half of Americans have a very minimal amount in a savings account. We are consumer driven. This means we simply like to spend money. There are three good reads in this category (again, you can get them for free or cheap on eBay) that have helped me understand how to save. The first book is The Millionaire Next Door. Think the guy next to you on the freeway in the Porsche is rich? Think again. he’s probably subject to excessive debt. Once you read this book, your whole view of money and savings will change.

The next book is The Richest Man in Babylon. This book is so time tested it was first published in 1926. It continues to be a financial best seller. Once you realize how much you waste money, and begin to want to save you can also read this pamphlet on investing. It is free and can be found here. Follow that link and download the free pdf file. You won’t regret it. Saving and obtaining more money takes time, patience, and effort, but it is doable.

Once you have some savings you can also meet with a Certified Financial Planner who can give you sound and ethical investment advice.

- Keep Track of Your Money

As an Affordable Las Vegas Lawyer, I know from first hand experience that you can’t get out of debt or save money without being detail oriented. This means you have to know how much money you have down to the penny. For years I’ve been entering every single dollar and cent that comes in and out of our accounts on a daily basis. This was a hassle at first, but now it is habit, and I have to do it. I personally use Accounts2 from the iTunes app store. It is 0.99 cents on the app store. Each day I enter how much money was spent or earned.

Within the app, you can add or subtract as many accounts as you want. You can also transfer money in the app from one account to another after you’ve done it online or at the bank so your records are in sync with your actual bank account. In just a few seconds I can look and see how much money is in each account. This helps me keep track of my spending on a daily basis, rather than casually looking at my checking account every now and again. This is an absolute basis for financial freedom.

- Budget

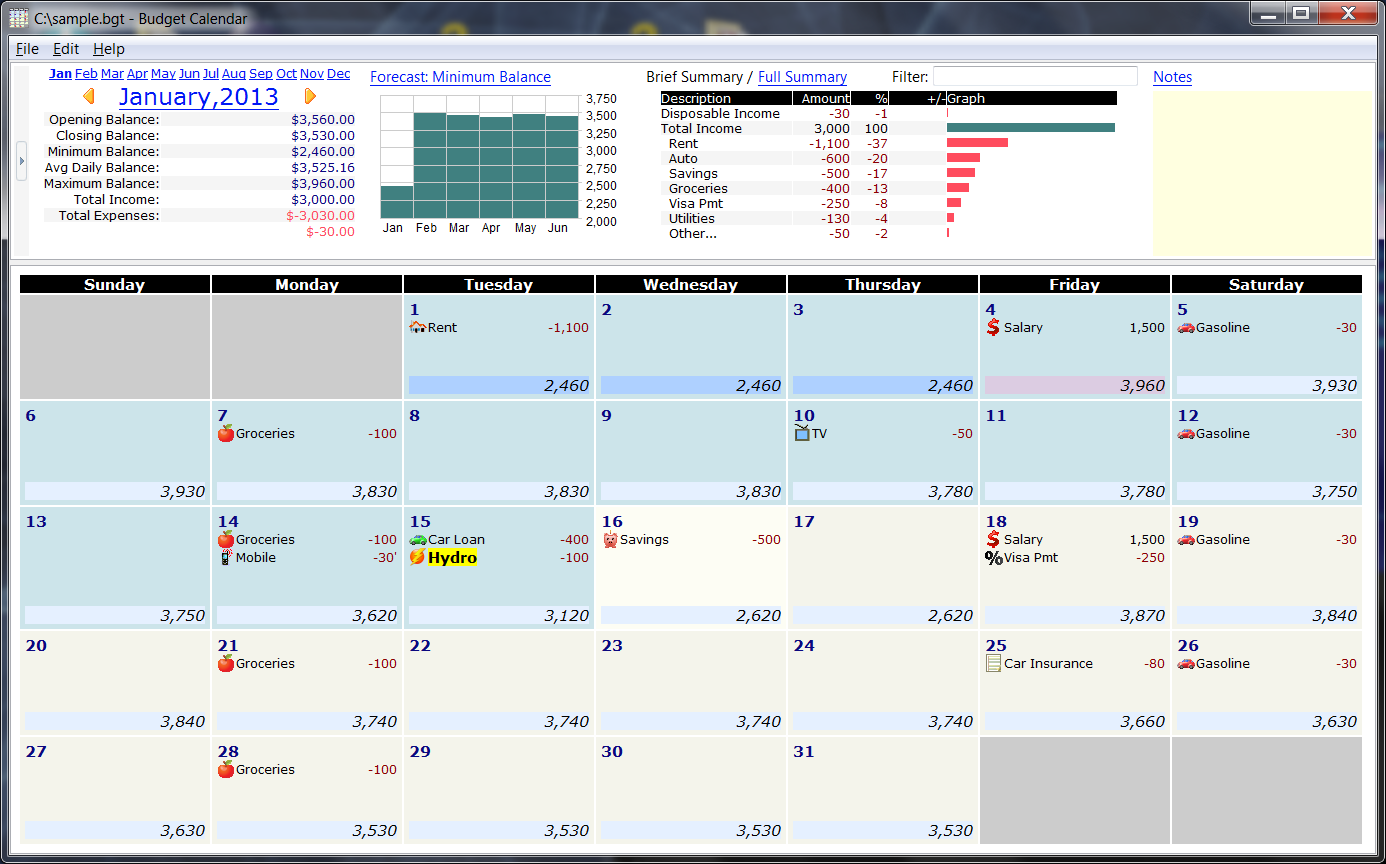

Perhaps the most important thing about being an Affordable Las Vegas Lawyer and advising clients who are dealing with debt, is the absolute foundation of financial freedom: budgeting. There are a variety of ways of how to budget. I think most people simply use an excel spreadsheet. By that method one would enter in the amount of monthly income, then subtract their bills leaving a total at the end of the month. I personally like to have a little more detail and see it in a different format. Thankfully, I found a “calendar budget” online. I’ve been using this computer program for several years and look at it almost weekly. It costs $29.95 for a lifetime use. I believe there is also a 30 day free trial version.

I like seeing my budget in this format because I can preset when my income comes in on a regular basis each month. I can also preset my monthly bills so I don’t have to constantly mess with the numbers. Those presets project for four years so I can fast forward in the calendar and see how much money I could save in four years time. Each month, the four years projects forward again, so it is always four years ahead.

As the current month moves forward, I can add the little things that come up. Still, I can definitely see at the end of each month how much money I will have left over and can place into savings. Another helpful portion of this program is the information it shows up top. It also places your spending into categories so you can compare that with your account app on your phone and adjust as necessary.

- Increase Your Credit

One other way this Affordable Las Vegas Lawyer can help you regarding your credit issues is to obtain a “secured credit card.” A secured credit card is backed by a cash deposit to the credit card company by you. Generally this is in the $50 to $100 range. You pay this amount up front, and the company provides you with a small credit limit to start. This is usually in the $150 to $200 range. Still, as you move forward responsibly within a few months your credit amount will increase. I don’t think any of these cards will ever give you a credit amount in excess of $750. However, if you don’t use the card, or simply pay it off immediately once you use it, your credit will increase because your score is based partially on the percentage of credit card use. Zero percent of credit card use will boost your credit fairly rapidly. Here is a link to researching secured credit cards further: https://www.creditcards.com/secured/.

- Join a Financial Self-Reliance Group

I would never suggest pushing religion on anyone. However, the Church of Jesus Christ of Latter-Day Saints, in partnership with the NAACP, is offering free to the public financial assistance groups. These groups meet weekly for a twelve week period for each course. I have heard several people that have taken the course tell me how it has completely changed their financial outlook on life. The courses vary from group meetings about starting a business, obtaining better employment, getting out of debt, etc. More information can be accessed here.

If you have questions about credit, help with a creditor issue, or any other contractual or legal need, please call Rise Legal – Steve Dixon Law to speak with an Affordable Las Vegas Lawyer at (702) 329-4911 today.